It’s that time of year again: the Library Research Service (LRS) has received and reviewed the latest Public Library Annual Report (PLAR) data and can begin to dig into it to see what we find! This 2023 PLAR data is still preliminary, but a snapshot of certain statistics are available on our website and our survey platform, Counting Opinions. While it’s tempting to transform this treasure trove of information straight into shiny, new visualizations, this is an important time to remind ourselves that fully understanding a data set is key to the successful analysis and visualization of it.

So, in this post, we’re going to dive right into one of the most important and complex pieces of public library data which is libraries’ local operating revenues. But before we visualize this data, we’ll take an in-depth look at each revenue type to make sure we fully grasp the information at our fingertips.

Local Revenue Leads the Way

Before we focus on local operating revenues, let’s take a step back and look at the landscape of public library funding in Colorado as a whole. The PLAR collects data on both capital revenue and operating revenue. Capital revenue means the funds that are designated for major capital expenditures such as buildings or vehicles. Any funds designated for routine expenses and day-to-day operations are categorized as operating revenue.

The public library survey asks libraries to report revenue from local, state, and federal funding sources as well as any other revenue that does not fit into one of these categories (such as donations, fines, or private funding sources). Although most public libraries in Colorado receive state revenue for operations and some receive federal funding, combined this revenue made up less than 1% of total operating revenue for all Colorado public libraries in 2023. Local revenue on the other hand made up around 93% of all Colorado public libraries’ operating revenue. Just over 6% of all operating revenue came from other sources. Libraries’ individual reporting shows that 82% of Colorado public libraries garnered at least three-fourths of their revenue from local sources. Since local operating revenue is the vast majority of our Colorado public libraries’ funding, let’s break it down even further.

Local Revenue Paths

There are a variety of ways in which public libraries across Colorado are governed, which means they are also funded in a variety of ways. The majority of libraries are either their own library districts, part of a municipal government, or part of a county’s system, although there are several libraries that don’t fall neatly into one of these three categories. The type of local government structure that a library is a part of influences where its local operating revenue comes from. For example, the majority of libraries run by their municipal government gain much of their funding from the city’s general fund while most of the funding for library districts comes from district mill levies paid via property taxes. All in all, there are seven different potential sources for libraries’ local operating revenues, including city or county general funds, city or county sales taxes, and city, county, or district mill levies. Some libraries are funded by just one source, but many are funded by two, three, or even four different sources. In fact, for the 106 libraries that reported local operating revenue in 2023, there were 20 different combinations of sources for the local operating revenue reported! For example, some library districts received only district mill levy funding, while others received revenue from a county sales tax and a district mill levy, and some received money from a county general fund as well.

With all the different combinations of funding sources, it takes some time to sort through this data and make meaning out of it. This data set is complicated further by the fact that a library’s legal designation does not always predict what type of funding it receives. For example, Upper San Juan Library District reported local operating revenue only from a county’s general fund and not a district mill levy, which differs from most library districts in 2023. Additionally, libraries’ funding does not always come from the same source from year to year. Boulder Public Library, for example, changed from being funded mostly by the city’s general fund in 2022 to being funded entirely by a district mill levy in 2023.

Learning From Local Revenue Data

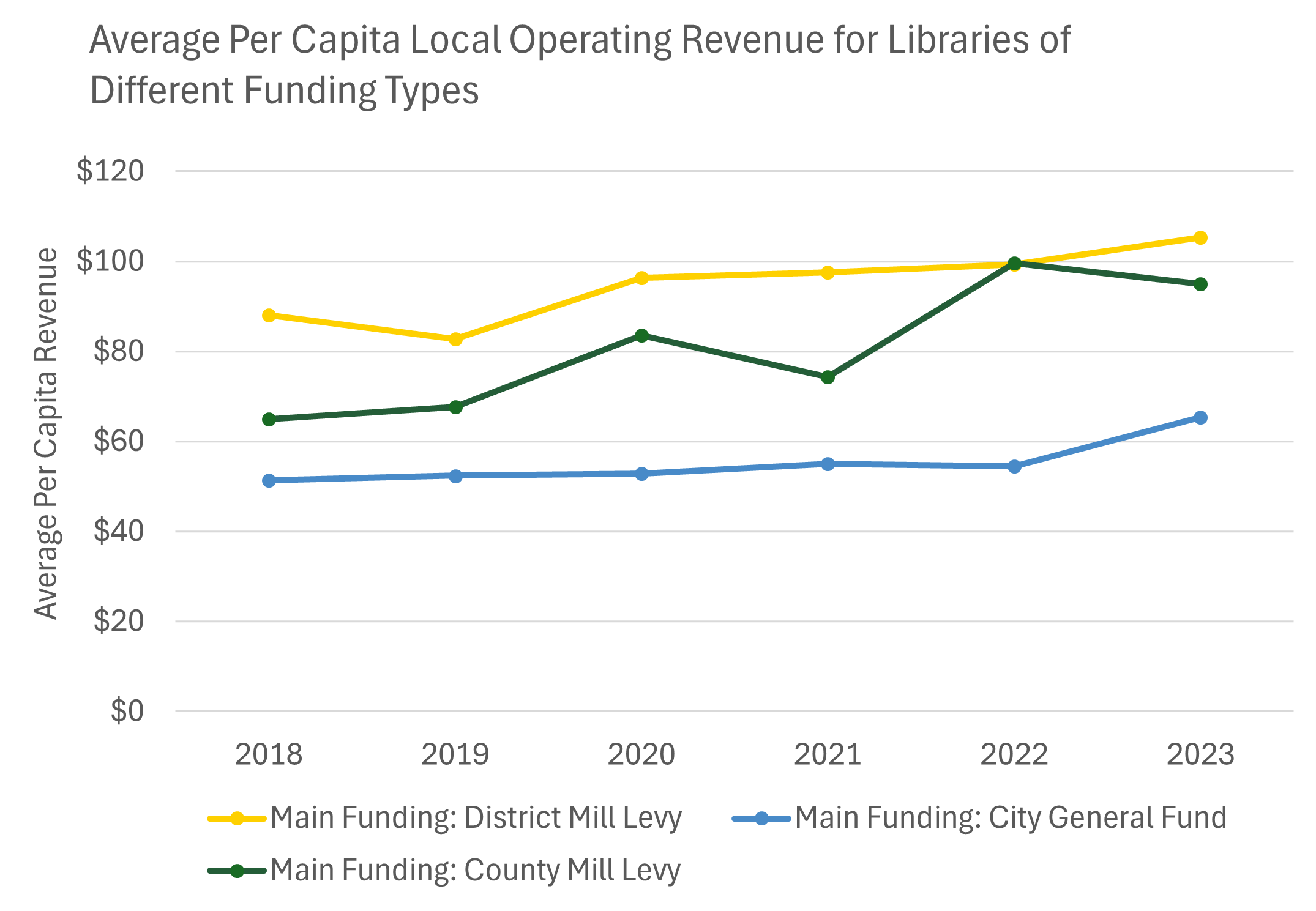

Sorting through and mapping out these different local revenue sources gives us a better understanding of the data, including what we might learn from it. One question this data may be able to answer is whether some funding sources are more stable than others. For example, one may speculate that a city or county’s general fund might be more susceptible to the local government’s budget health than a district mill levy. In an attempt to assess whether there is evidence to back up this theory I created Figure A below, which compares the average local operating revenue per capita of libraries with different funding sources over time. I chose to sort the libraries by their primary funding source each year to calculate the averages over time and not use a standard grouping such as their legal basis (e.g., library district, municipal government, and county/parish) in Figure A because of the variations in funding sources within these groupings discussed above.

Ultimately, there are just too many different combinations of funding to fit on one chart neatly, so Figure A focuses on the three most common types of funding: libraries that are mainly funded by district mill levies (48%), libraries mainly funded by a city’s general fund (28%), and libraries mainly funded by a county mill levy (8%). The remaining libraries, which were primarily funded by sales taxes, a county general fund, or did not report any local operating revenue, are not included in Figure A.

Of the three different funding types that are included, Figure A shows that libraries with the majority of local revenue from district mill levies have higher per capita funding on average than county mill levies or city general funds. Libraries funded by a city’s general fund have lower per capita funding on average. However, the per capita average local operating revenue for both libraries funded by district mill levies and cities’ general funds stayed fairly steady and increased between 2022 and 2023. Per capita local operating revenue for libraries funded by county mill levies has also grown since 2018 but, unlike the other two categories, it dropped in both 2021 and 2023.

With 20 different combinations of local funding sources for 106 libraries that reported local operating revenue in 2023, and changes from year to year, comparing the fluctuations of different local operating revenue sources over time takes careful consideration. Diving beneath the surface to understand the breakdown of the data was necessary to know how best to visualize these changes. Although Figure A does not show large fluctuations in average local operating revenue for libraries funded by city general funds, this does not necessarily mean that individual libraries do not see major fluctuations. A more detailed look at individual libraries might tell a different story. It wasn’t until I had really dug under the surface to understand this data set that I realized just how many factors there were to consider during analysis. This shows just how important it is to spend time exploring your data set before jumping right into visualizations. You never know what you might find!

LRS’s Colorado Public Library Data Users Group (DUG) mailing list provides instructions on data analysis and visualization, LRS news, and PLAR updates. To receive posts via email, please complete this form.